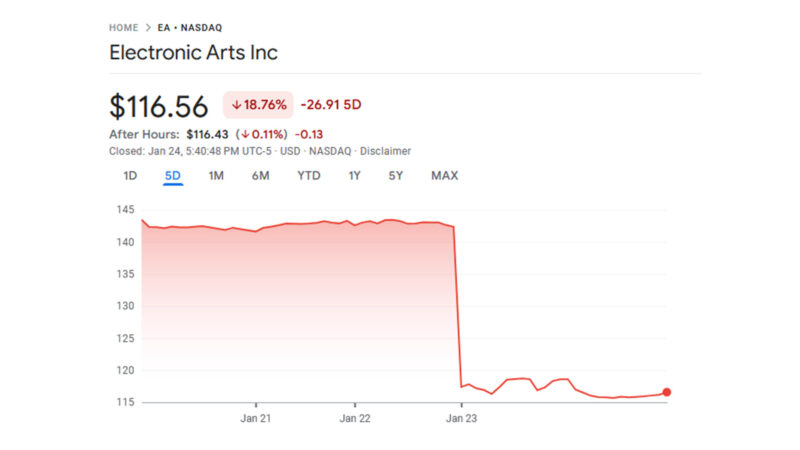

Electronic Arts (EA) is feeling the heat, with its shares dropping by a staggering 18% marking the company’s worst single-day decline since 2008. The culprit? A combination of underwhelming sales for EA SPORTS FC 25 and lackluster performance of Dragon Age: The Veilguard. These missteps have shaken investor confidence and cast doubt on EA’s fiscal projections for 2025.

EA SPORTS FC 25 Didn’t Hit the Mark

Since its September release, EA SPORTS FC 25 has struggled to live up to the legacy of its FIFA-branded predecessors. While initial excitement was high, mixed reviews from players and critics have impacted sales. By December, the momentum from the game’s launch had faded, leading to a significant drop in net bookings. EA’s projections for Q3 were between $2.4 billion and $2.55 billion, but they fell short, posting $2.22 billion instead.

When Players Speak, EA Listens (Sort Of)

One thing that stands out here is how much power players have when sales dip. EA quickly released a major gameplay patch to fix online issues that many players had been complaining about. The patch improved online gameplay and got some positive feedback from the community.

But there’s a flip side. Offline players were left frustrated, with many saying the patch made single-player modes nearly unplayable. This shows how far EA is willing to go to protect its profits. Fixing online gameplay seems to take priority, even if it means upsetting those who prefer offline modes.

While you guys have fixed FUT AI defending, you've completely eliminated the offline player's challenge against the CPU defensively. We're back to FIFA 21 and 22 passive defending. All that hard work and progression, completely undone. https://t.co/Bj1nWxXBpm

— Matt10 (@Matt10L) January 21, 2025

The Live Service Gamble

EA relies heavily on live services, especially Ultimate Team. These services bring in a huge chunk of EA’s revenue, as they accounted for 73% of EA’s revenue in 2024, but they’re starting to show cracks. The company had predicted growth for this part of the business, but it’s now expecting a 5% decline instead.

A lot of players have been unhappy with things like inconsistent gameplay, dynamic difficulty, and expensive in-game packs. This frustration seems to be pushing some people away from Ultimate Team, which is bad news for EA’s bottom line.

What This Means for EA

The struggles with EA SPORTS FC 25 have forced EA to lower its yearly revenue forecast by hundreds of millions of dollars. The new estimate is between $7 billion and $7.15 billion, down from their earlier prediction of $7.5 billion to $7.8 billion.

EA’s Response and What’s Next

Despite these challenges, EA’s CEO Andrew Wilson expressed confidence in the company’s future, stating, “We remain confident in our long-term strategy and expect a return to growth in FY26, as we execute against our pipeline”. The recent gameplay updates and Team of the Year (TOTY) content for EA SPORTS FC 25 have been well-received by online players, but it’s clear there’s still a lot to fix. Offline players, in particular, feel left behind.

While EA’s stock drop is a wake-up call for investors, it’s also a reflection of the shifting expectations of players in a live-service-heavy gaming world. As EA SPORTS FC 25 tries to regain its footing, one thing is clear: fans still hold significant power over the fate of gaming’s biggest franchises. If EA hopes to bounce back, listening to its community may be its best play yet.

Let’s see what the full earnings report on February 4 will reveal about EA’s plans for recovery. For now, the ball’s in their court.